Hyper-Personalized Digital Banking: How AI Is Revolutionizing Customer Experience

Banking That Knows You: Powered by AI, Driven by Real-Time Data

In today’s fast-paced, digital-first world, customers expect their banking experiences to be as intuitive as Netflix and as seamless as Spotify. Traditional banking models often struggle to meet these expectations—missing the mark on personalization, engagement, and real-time relevance.

That’s where hyper-personalized digital banking comes in.

At BankBuddy.ai, we turn raw customer data into meaningful, real-time interactions. By combining artificial intelligence (AI), behavioral analytics, and omnichannel automation, we deliver deeply personalized banking experiences that build trust, drive engagement, and accelerate growth.

Why Hyper-Personalization Is a Game-Changer in Digital Banking

Modern banking customers don’t want one-size-fits-all messaging or generic product pitches.

They expect banks to:

- Understand their unique financial habits

- Predict their evolving needs

- Offer proactive, relevant financial advice

But the reality is stark: Most banks have the data—but not the systems to use it intelligently or in real time.

That’s the personalization gap.

Hyper-personalization bridges this gap by leveraging AI and machine learning to create 1:1 banking experiences across every digital touchpoint—mobile, web, chat, and more.

What Is Hyper-Personalized Digital Banking?Hyper-personalization in banking refers to the use of AI, ML, and real-time analytics to tailor financial experiences to individual customers—not segments.

Unlike basic personalization, it uses detailed behavioral data to deliver:

- Real-time product recommendations

- Proactive financial tips and insights

- Omnichannel support tailored to context and intent

It’s banking that adapts to the customer —not the other way around.

The 6 Pillars of AI-Driven Hyper-Personalized Digital Banking Real-Time EngagementEngage customers instantly across digital channels based on live interactions.

Predictive IntelligenceAnticipate needs before they arise using machine learning and behavioral modeling.

Contextual InsightsProvide relevant, timely advice that simplifies decision-making.

Omnichannel ConsistencyDeliver seamless experiences across mobile apps, web portals, voice assistants, and in-branch systems.

Adaptive Product OfferingsTailor financial products based on evolving life stages, behaviors, and preferences.

Conversational AIEnable natural, multilingual 24/7 conversations via chatbots, voice, and messaging apps.

Why BankBuddy.ai Leads the Future of Digital Banking Personalization

BankBuddy.ai is not just another chatbot or CRM system. We’re a full-stack real-time personalization engine built exclusively for digital banking transformation.

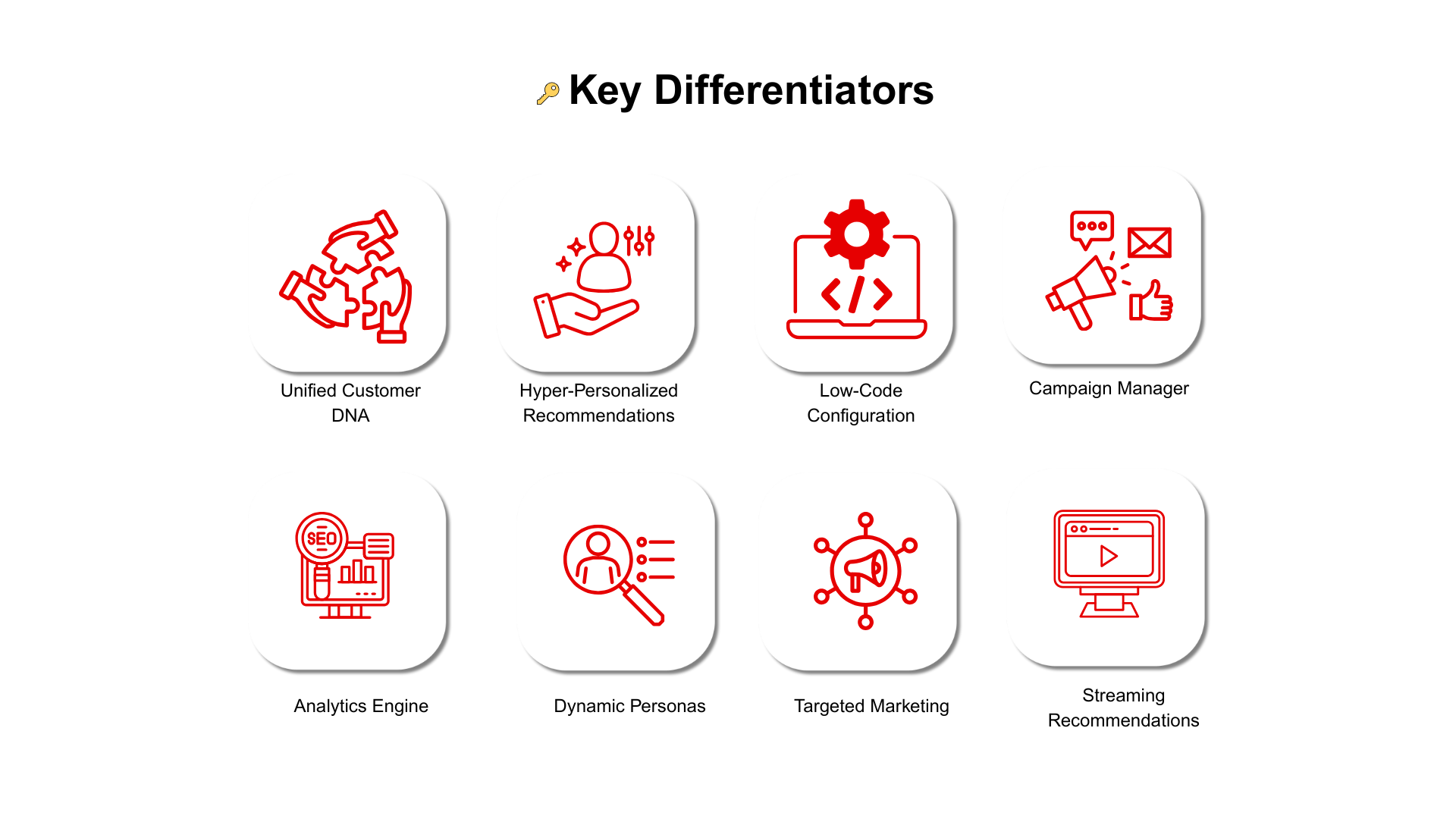

Unified Customer DNAWe aggregate data from transactions, behavior, devices, demographics, and social signals—offering banks a 360° real-time customer view.

Real-Time RecommendationsOur AI models predict next-best actions, boosting cross-sell/upsell conversions through personalized financial journeys.

Low-Code, High-Speed ExecutionBusiness teams can launch new campaigns, automate actions, and respond to behavior changes in minutes—no heavy IT dependency required.

Intelligent Campaign OrchestrationRun multi-channel campaigns via WhatsApp, email, chat, and more—with built-in automation, dynamic filters, and real-time tracking.

Deep Analytics & Predictive ModelingAccess 50+ out-of-the-box reports, dashboards, and behavioral analytics—enabling churn prediction, CLV analysis, and affinity scoring.

Streaming Personalization Across ChannelsDeliver hyper-relevant offers and support on mobile, web, voice, and messaging platforms—including WhatsApp, Messenger, Alexa, and more.

Streaming Personalization Across Channels

Business Impact: Why Hyper-Personalization Drives ROI in Digital Banking+10–15% Revenue Uplift

According to McKinsey, personalized customer interactions can boost banking revenues by 10–15% through better conversions and deeper engagement.

56% Higher Repeat EngagementA Twilio study shows that customers who receive personalized experiences are 56% more likely to return—leading to improved loyalty and retention.

Bottom line? Personalization in digital banking isn’t a nice-to-have. It’s a competitive necessity and a revenue accelerator.

The Future of Banking Is PersonalHyper-personalization is no longer a trend—it’s the benchmark. Today’s digital banking leaders must combine AI-powered insight, contextual understanding, and omnichannel execution to deliver experiences that feel human, not transactional.

At BankBuddy.ai, we help banks transform from service providers into financial partners—building customer relationships that last.

Ready to transform how your bank connects with customers?Schedule a demo with BankBuddy.ai →

Let’s build banking that understands people — not just portfolios.